The smartest way to make business payments

Tap into your available credit card limit and digitise your payment processes for any business expense.

Why use CardUp for your business payments?

Keep more cash on hand

Defer payments for up to 2 months when you use your credit card. CardUp is cheaper and faster than many other financing tools.

Digitise and automate

Save up to 50% of your time by easily automating your payables with our invoice tools. No training or tech skills required.

Earn rewards

Earn up to miles, points or cashback on business expenses you're already paying for.

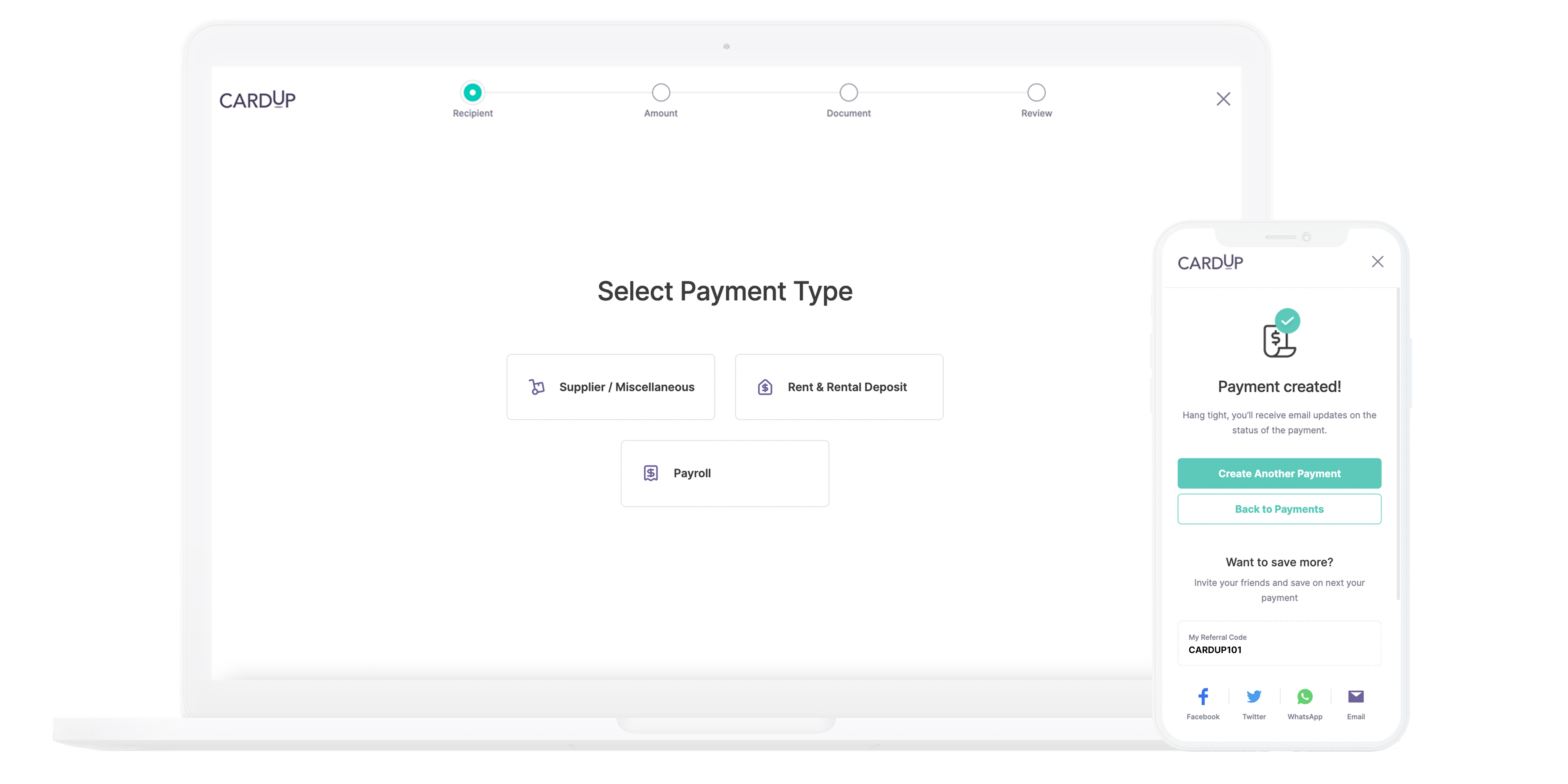

How it works

1. Set up a payment

Scan your invoices, verify the recipient information and enter your card details. You can pay anyone, even if they don't use CardUp.

2. Recipient gets paid

The payment is charged directly to your card with a small CardUp fee. Your recipient receives the funds via bank transfer in as fast as one business day.

3. Enjoy card benefits

Get up to 2 months of interest-free working capital when you pay with your card. You can also start earning rewards such as points, cashback and miles.

Pay virtually any business expense by card

Transform the way you pay - shift these payments onto your card and make full use of your pre-approved credit line

Rent

Supplier Invoice

Payroll

New User Promotion: 0% fees!

Enjoy 0% fees on any business expense when you submit your details below:

Business payments made simple with CardUp

SCHEDULED PAYMENTS

Pay on time, every time

Gone are the days of setting up payment reminders. Set up a recurring payment on CardUp and never worry about late fees again. You may even get an early payment discount from your suppliers!

REFERRAL PROGRAM

Even more features to transform the way you pay

Team management

Assign roles to different team members

Flexible Schedules

Set up one-off or recurring payments in advance

Dashboard monitoring

See all past and upcoming scheduled payments on one page

Real-time updates

Receive payment status updates and alerts via email and SMS

Manage multiple cards

Add and choose the right cards for each payment

Simple, transparent pricing

Access one of the fastest and most convenient sources of working capital. 0% fee to start making payments. No hidden cost or setup fees!

Join the thousands of businesses who already trust CardUp

"With CardUp, we've been able to capture the miles on our business payments to reduce overall travel expenses for our business."

Michael Finn

Director | The Fifth Collection

"CardUp's unique platform helps optimise cash flow, especially in a small team to keep operations going smoothly."

Jeremy Tan

Team Lead | Paula's Choice

"With CardUp, I’m able to minimise cash flow gaps and keep my business running without disruption.'

Dr Chong

Managing Director | Aviation Virtual

"I'm now able to optimise working capital for my business at a flexible and affordable rate. It also helps us process our payments timely."

Nina Alag Sure

CEO | X0PA AI

"With CardUp, my team is now able to collaborate and get a consolidated view of our business spend each month."

Chew Kee Pte Ltd

Finance Lead

"A clear value-add is the ability to access interest-free credit to help drive working capital needs for large recurring business. This has been pivotal in helping drive healthy working capital ratios."

Jerrold Quek

Chief Operating Officer | Far Ocean Group

"CardUp is a good platform for me to utilise my credit limit to ease my cashflow, earn reward points and get additional timeline for my supplier payments."

Lenny Lim

Director | Crowd Pte Ltd

“We’ve saved about 16 man-hours per month now that our payroll to employees is automated via CardUp. We’re also able to use the additional cash on hand to prioritise business operations.”

Isaac Kow

Chief Executive Officer | GoBuddy

Have questions about using CardUp for your payments?

What business payments can I make with CardUp?

Our platform lets you shift payments currently made by cash, cheque or bank transfers onto your credit cards, even where cards are not accepted. These include payments such as rent, payroll, supplier invoices and more. You can view the full list of accepted payments here.

How does using my credit card free up my cash flow for 2 months?

When you use a credit card to make a payment, your recipient still gets paid on time, while you defer the actual outflow of your cash until your card bill is due. This lets you gain up to two months of extended payment terms.

Will I earn rewards on my credit card for payments made through CardUp?

All spend made using a Malaysia-issued card on your CardUp-registered account are eligible for the base earn rate* of miles, points or cashback on most credit cards, including for payments such as payroll premiums and rent.

Manage your business expenses better

Join businesses across 40 industries that have optimised their business expenses with CardUp